What are average rental yields on HMO properties?

We are often asked the above question as it can be the main motivation for investing in a House in Multiple Occupations (HMO). Because of this, we’ve outlined some explanations, considerations and information on rental yields and their role in the current HMO (UK) rental market.*

What are rental yields, and why they are important when considering a buy to let HMO property.

Rental yields refer to the potential returns on a rental property, presented as a percentage, and are calculated on the value of the property and the annual rental income. You may hear it referred to as a gross rental yield (the percentage before costs are deducted) or the net rental yield (the percentage after all costs associated with owning a property are deducted.)

Calculating what your potential rental yield is will help you determine whether a buy-to-let property is a sound investment. It will also help you set out what you should charge for your rental property and also help you make decisions on what property you should buy if you are looking at several investments. Be mindful too that although rental yields are a deciding factor on purchasing a HMO, factors such as rental demand in an area and capital growth should also be considered. At Reka, we know the landscape and can help you with this.

How do you work out the rental yield of a property?

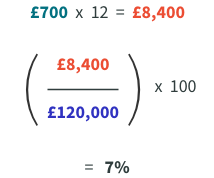

The simple example below shows how this can be done. If Mike buys a property for £120,000 and receives £700 in rent each month, his gross rental yield on this is 7%.

What affects a rental yield on a HMO property?

Location

Several factors can affect the rental yield of your HMO property. The location of your rental property will influence the property rental yield and the Right Move Rental Tracker provides some insights into the current rental market. This can be found here. As you would expect, London demands the highest rates, with an average rent in the capital being £2,567** and outside of London being approximately £1,231 per calendar month (pcm)**

Property Type

HMOs have higher rental yields than standard properties as they can offer more rental opportunities due to having more tenants. It also spreads the risk of an empty property, due to the number of tenants in it. It’s very rare to have a HMO with no tenants.

Other Factors

Supply and demand – The higher the demand for your property; the higher the rent.

Maintenance – the less maintenance required will positively impact your rental yield.

Empty properties – if you do not have tenants, then your rental yield will drop. This is why a HMO, which by its nature has several tenants, is worth considering.

What is a good rental yield percentage?

As mention above, there are several factors which can impact your rental yield, but it is widely accepted that a good percentage is around 5-6%, and 7% is seen as ‘very good’.

This figure increases when you consider a HMO, with a gross rental yield percentage of 8-12% for most HMO properties. ^

How can Reka Property Management help?

With an extensive knowledge of HMOs and local areas, Reka specialises in HMOs – including converting properties into HMOs, sourcing tenants and managing your properties – and our seamless approach means that you can be hands off, or hands on, depending on what suits you.

Douglas Fouko, Reka’s MD said:

‘It’s never been a better time to invest in HMOs. The rental market is bouyont, and we have seen significant growth in the rental yield percentages that our clients are receiving on their investments. We are landlords and property investors ourselves, so we know how this can make sound business sense.’

To learn more about how we can help, please contact us on 0203 286 6468 or email Admin@RekaProperty.co.uk

Please note that the information above does not constitute legal advice.